Contact Information

Ellen R. McGrattan

4-161 Hanson Hall

612-625-6714

erm@umn.edu

Office Hours

By appointment

Mailing Address

Department of Economics

University of Minnesota

4-101 Hanson Hall

1925 4th St S

Minneapolis, MN 55455

Corporate Taxation

In this project, we created a longitudinal dataset of corporate tax records using 10-K files for thousands of firms between 1994 and 2020 available from the SEC's Edgar website. Of particular interest are statutory and effective tax rates, along with the US-GAAP components that reconcile them. Ultimately, we seek to use these data to estimate the impacts of tax and innovation policies on global capital stocks and flows.

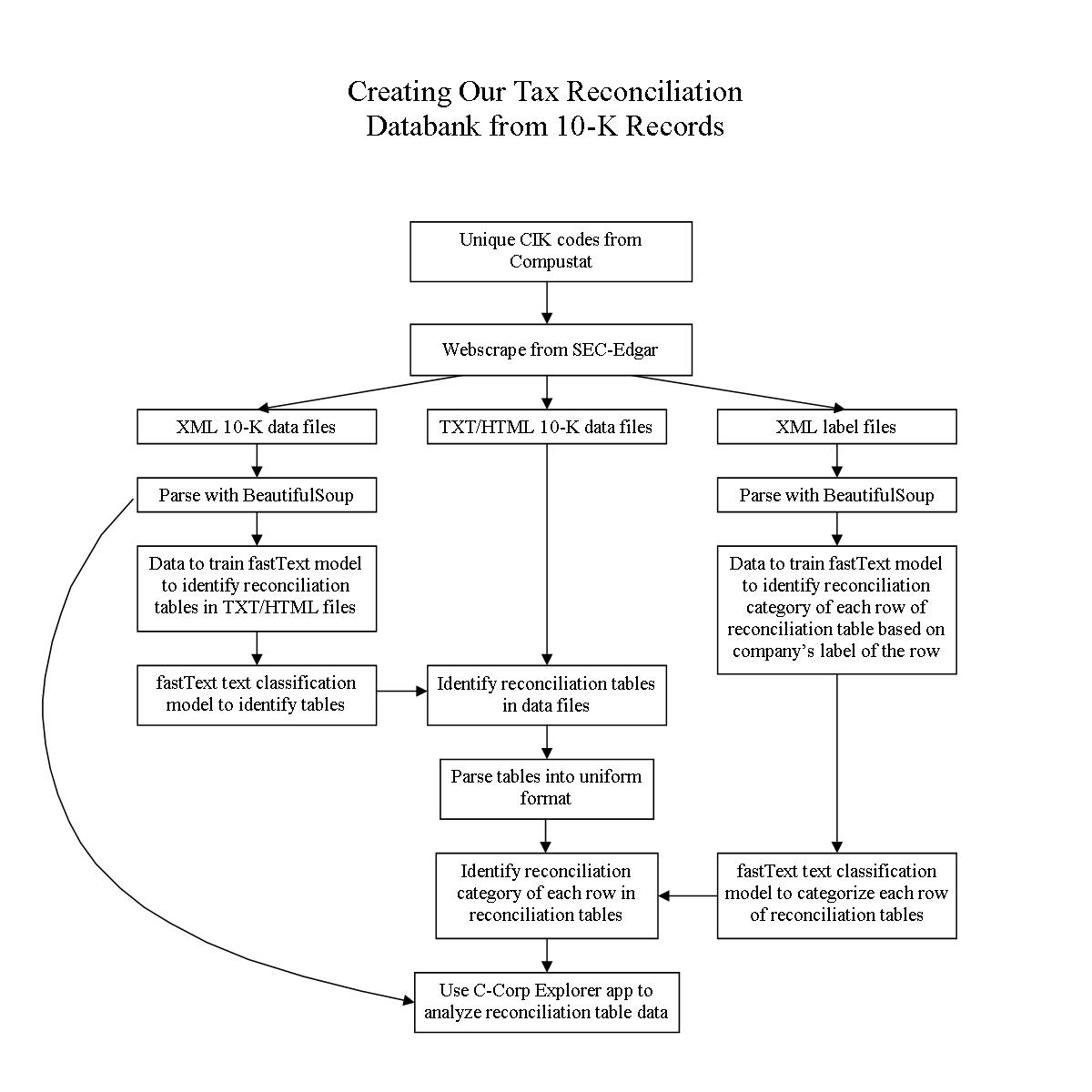

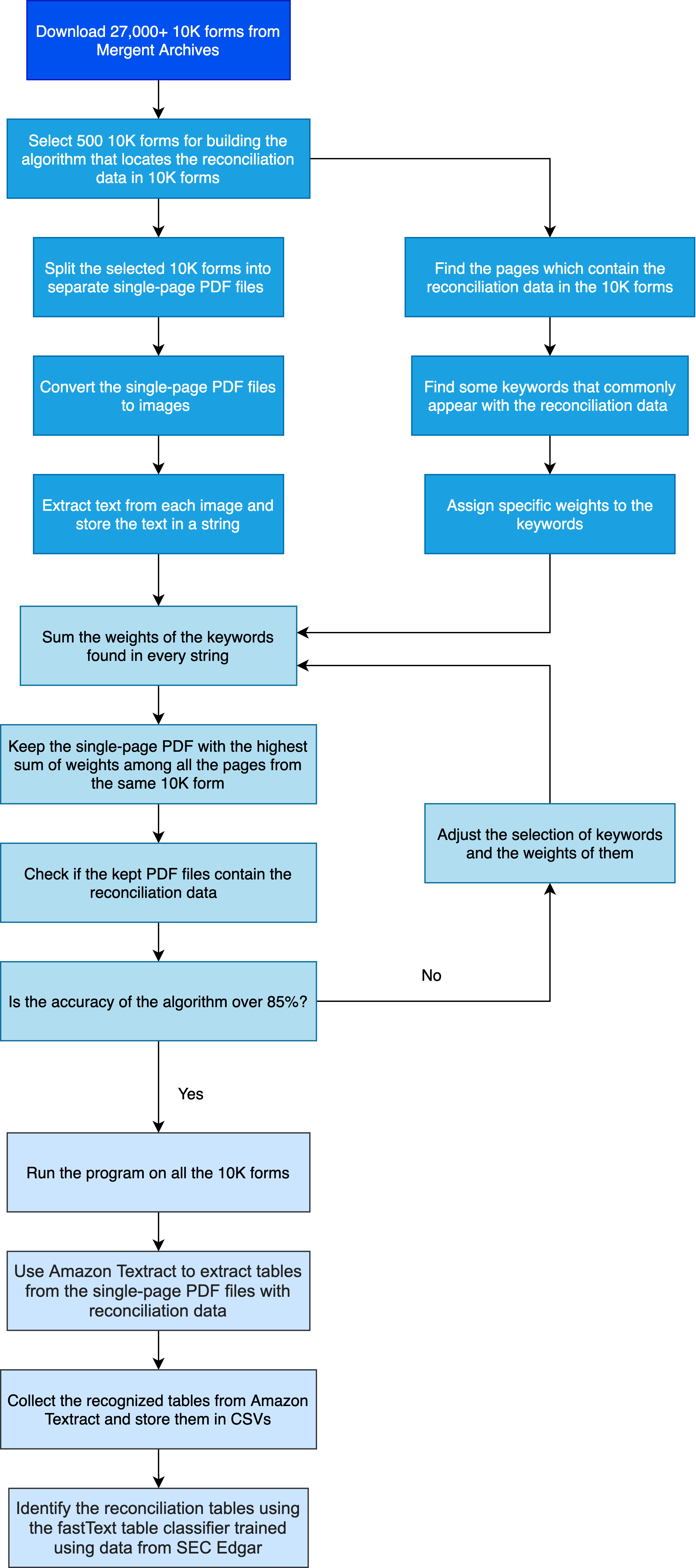

The first stage of the project is the creation of our reconciliation databank (see the first flowchart below), which requires extraction of effective tax rates and tax reconciliation data from the SEC's EDGAR database. The flowchart represents the end-result of that process. In short, we went from unique company identifiers to 10-K files from EDGAR to data analysis in an R Shiny web app (shown below) using modern statistical and programming tools at each stage. Soon, we will be adding data prior to 1994 for published 10-K files in the Mergent Archives (see the second flowchart and an illustration below).

Then, Jackson developed an R Shiny web app, the "C-Corp Explorer," to visualize and analyze Compustat data along with the tax rates. Since the data is proprietory, interested users would need to prove that they already have access to the dataset before using the app.

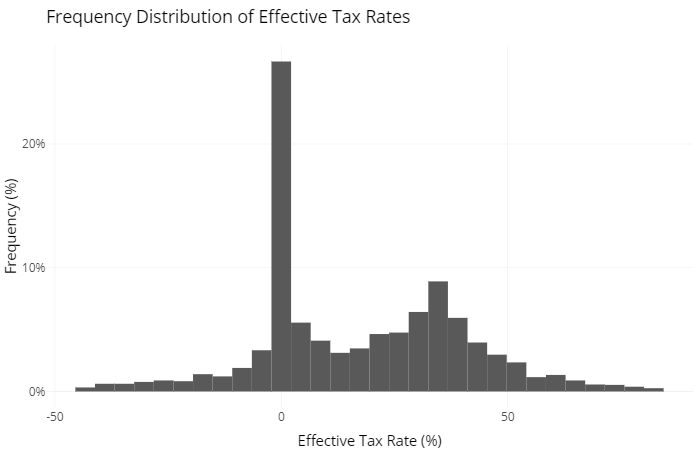

One of the most interesting results is the extreme firm-level heterogeneity in the data. Take, for example, the distribution of effective tax rates for 2017 shown below. Even after trimming so that we only see the 5th through 95th percentiles, there is still a spread of nearly one hundred percentage points in effective tax rates and many firms pay "negative" or zero taxes.

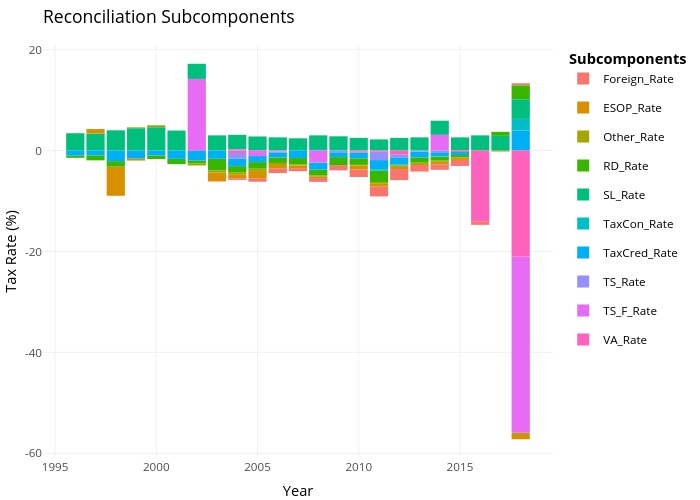

Below, we show median values for each component of the tax reconciliation data over time.

For tax rate reconciliations prior to 1994, Guangqi uses OCR software and pdfs from the Mergent archives. Here is how he does it:

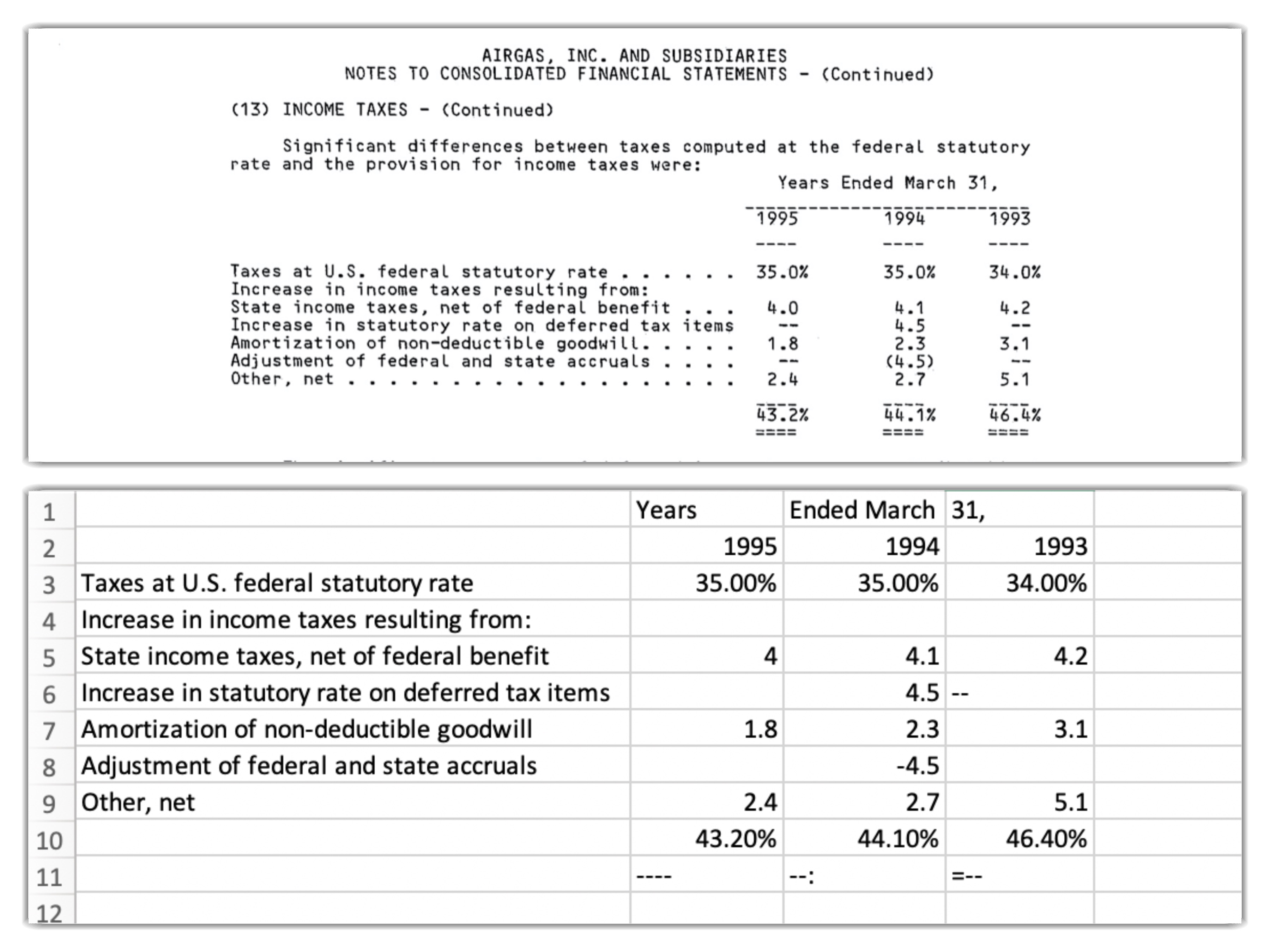

Here is an example: