Econ 1101/1165—Reading 1

Auction Markets for Electricity in the United

Kingdom

By Thomas J. Holmes, Dept. of

Economics, University of Minnesota

There

are a variety of important markets throughout the world where exchange takes

place through auctions. (E.g., government bonds, internet advertising, used

cars, etc.) A discussion of how

auctions work is a good way to start an economics class because the basic

mechanism through which price is arrived at is relatively easy to understand.

This reading discusses how a particular auction works.

The

market is wholesale electricity in the United Kingdom. Before 1990, electric power in the UK was

provided by a single firm that both produced and distributed power to

consumers. (In economics, we say that

such a firm is vertically-integrated,

because the firm is at the beginning and the end of the production

process.) The firm was a government

monopoly, analogous to the way the Postal Service is a government monopoly

here. In 1990, the industry was

restructured to introduce competition into the market. The industry was privatized and firms began competing to sell

electricity. There typically remained

only a single power cable going into any particular building. But that cable would be connected to a power

grid. The electricity flowing into the

building could come from potentially numerous suppliers connected to the

grid. With all these various firms

connected to the grid, there needs to be some way of coordinating things so

that the right amount of electricity is put into the grid, to ensure the lights

go one when someone flips a switch. Since 1990, the UK has used auctions to

coordinate production and to determine the wholesale price.

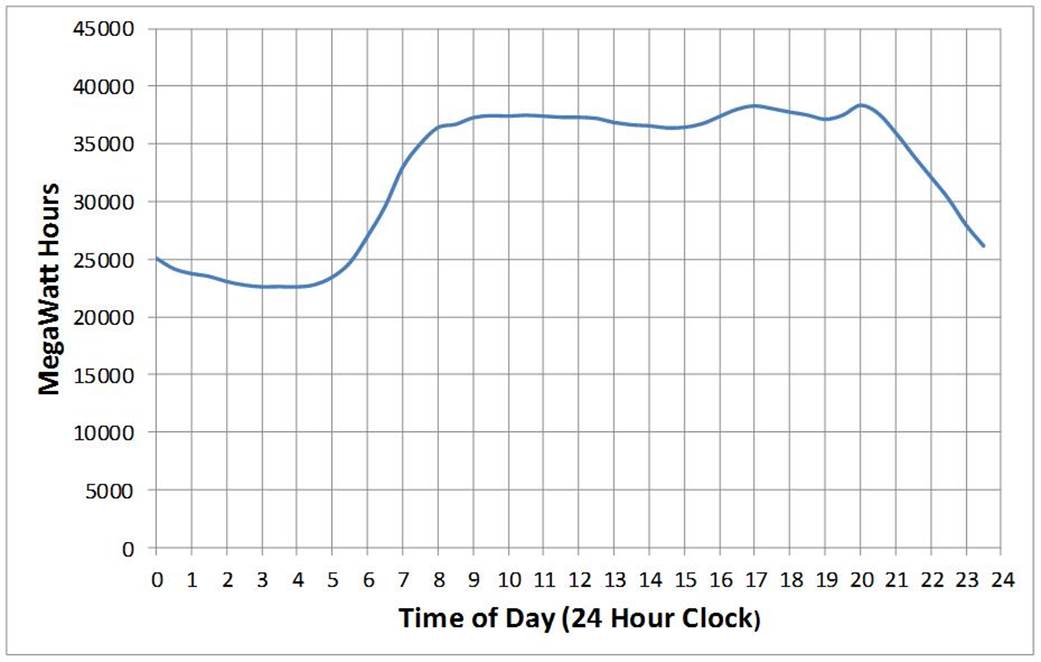

To

explain how the auction works, we need to give a little background about the

electricity market. The demand for

electricity varies substantially throughout the day. The first figure below plots the total

quantity of electricity demanded in the UK over the course of the day of Sept.

3, 2014. (This data is available on the web and the sources and details about

the data are discussed below.) The

horizontal axis is the hour of the day (according to a 24

hour clock). Notice that demand

is lowest in the early morning when the lights are out

and people tend to be sleeping. On this particular day

demand was 25,000 MWh in the early morning hours. Then, after 5:00 a.m., demand began going up

until it leveled off at approximately 37,000 MWh just after 8:00 a.m. Later in the evening (at 20:00 or 8:00 p.m.)

demand began to head back down again.

Electricity Demand in Great Britain on Sept 3, 2014

(MegaWatt Hours by Time of Day)

Source: Initial Demand

Out-Turn for 2014-09-03 as reported by www.bmreports.com

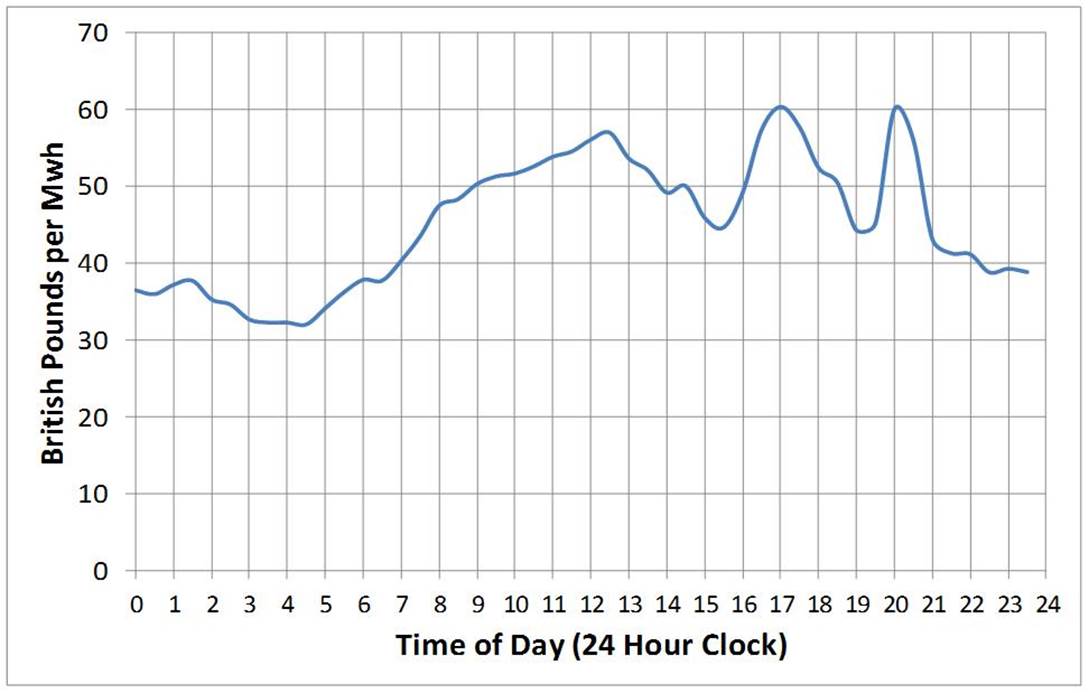

In the UK electricity

market, each half-hour period in a day is considered a separate market with its

own auction. Bidders submit a quantity

that they are willing to sell or buy, as well as the price for which they are

willing to engage in the transaction.

Bid information is gathered together and a

system price is determined for the particular half-hour period. The figure below reports price by time of day

on September 3, 2014. (This is called

the “reference price” and is reported by APX Power.) Notice that price was low in the early

morning hours, at around £35 per MWh, and began to go up after 5:00 a.m. just

as demand was increasing. Price hit a

peak of £60 per MWh at both 17:00 and 20:00 (5:00 p.m. and 8:00 p.m.) before

falling back below £40 by the end of the day. The price peaks at 17:00 and

20:00 matched the demand peaks at exactly the points in the day. But notice that price changed a lot more than

demand was changing! This high degree of

price volatility is common in wholesale electricity markets.

Reference Price of Electricity in Great Britain on Sept. 3,

2014

(British Pounds per MegaWatts

Hour, by Time of Day)

Source: APX Power

Reference Price for UK on 2014-09-03 as reported by www.bmreports.com

We

will illustrate how wholesale electricity markets work in a simple

example. It is common in these markets

for there to be an entity in charge of the auction called the Independent System Operator, who takes

the bids and determines the price that will clear the market. In our hypothetical example, let’s assume

demand at 10:00 is projected to be 40.5 megawatts. Suppose the independent system operator

receives the following bids to sell electricity.

Table 1

Example Bids Submitted

for 10:00 (unsorted)

|

Bidder Name |

Sell Price (£ per MHh) |

Quantity Offered (MHh) |

|

Power Gen |

24.00 |

15 |

|

Smelly Coal

Plant, Inc |

28.18 |

10 |

|

Ye Old Time

Electric |

40.00 |

10 |

|

Big Nukes,

Inc |

10.00 |

20 |

The

job of the independent system operator is to process the bid information to

determine (1) which suppliers will produce and how much each produces and (2)

the system price will be that each supplier will be paid. The first step in the process is to sort the

bids from lowest to highest. Lower

bidders are always in before higher bidders.

The next step is to add up the cumulative quantity supplied as we go

from the lowest to the highest bidders.

The trick is to go down the supply list until there is enough supply to

meet the demand (here 40.5 MWh). The

system price is set to be the bid offered by the last bidder in. All suppliers with lower bids get paid the

system price.

Let’s

pretend we are the independent system operator.

To process the bid information, it useful to set up a worksheet like

this that sorts the bids from lowest to highest:

Table 2

Independent System

Operator Worksheet

|

Bidder Name |

Sell Price (£ per MHh) |

Quantity Offered (MHh) |

Cumulative Quantity

Offered |

Market Demand |

Auction Result (amount

sold) |

|

Big Nukes,

Inc |

10.00 |

20 |

20 |

40.5 |

20 |

|

Power Gen |

24.00 |

15 |

35 |

40.5 |

15 |

|

Smelly Coal

Plant, Inc |

28.18 |

10 |

45 |

40.5 |

5.5 |

|

Ye Old Time

Electric |

40.00 |

10 |

55 |

40.5 |

0 |

In order to get a cumulative quantity

supplied big enough to meet the demand of 40.5, we need to go to the third

bidder on the list, Smelly Coal Plant, Inc.

(These cells are highlighted in yellow.) The system operator stops here and sets the

system price to the £28.18 per MWh bid by Smelly Coal (the cell highlighted in

blue). The two lowest bidders sell the

entire quantities that they offer and they are paid

the system price of £28.18. As the last

one in, Smelly Coal sells only part of what it offers, in

order to exactly match demand. Ye

Old Time Electric doesn’t sell anything.

But note that if the weather were hotter that day and more air

conditioners were running, electricity demand would have been higher. If the increase in demand were big enough, Ye

Old Time Electric would need to be brought in, raising the system price to

£40.00. With a high bid like this, Ye

Old Time Electric likely has an old inefficient plant. A costly-to-operate plant like this will

generally operate only at periods of unusually high demand.

To

see what is going on, it is also useful to plot the bids on a graph like

below. We start by plotting the prices

and cumulative quantities offered by the suppliers, (beginning with the lowest

to the highest bidders). This is in blue

in the figure below. The demand of 40.5

is in red. The intersection point

determines the system price.

An

auction like the one just described takes place for each of the half hour

period of the day. Suppliers submit

their bids on a daily basis. In the early morning when demand is low, the

only suppliers that operate are the ones setting low bids like the bid of Big

Nukes, Inc, and the system price is low.

Later in the day when demand is high, the system price is high.

Other

places around the world have followed the United Kingdom’s lead in deregulating

wholesale electricity markets. For

example, California has a wholesale electricity auction market that shares some

of the features of the British market.