Econ 1101—Reading 6

International Application: Intellectual

Property Protection and the Global Pharmaceutical Industry

By Thomas J. Holmes, Dept. of

Economics,

Revised August 28, 2010

for Econ 1101

This

Case Study begins by discussing the general economics of the global

pharmaceutical industry. Part 2

discusses a numerical example of drug pricing with patents. Part 3 analyzes the incentive for research

and development in the example. Part 4

wraps things up by mentioning recent international agreements concerning intellectual

property protection for the drug industry.

Part 1. A Brief Discussion of the Economics of the

Pharmaceutical Industry

It

is expensive to generate and test new drugs.

A study by the Congressional Budget Office report (CBO

(2006)) reports American pharmaceutical firms spend tens of billions of

dollars per year in research and development expenditures. (It reports a range of 20 to 50 billion

dollars that depends on whether costs of testing are included, whether overseas

affiliated are included, and so on.) Drug companies are willing to make these

investments because of the high profits that can be generated when a successful

new drug is generated and the company is awarded a patent. A patent grants the

company a monopoly on the drug. In the

United States, a patent lasts for 20 years.

When a patent expires, other companies are free to enter and market the

generic equivalent of a drug. When a

patent expires and the branded drug is forced to compete with generics, branded

drug revenues typically drop precipitously.

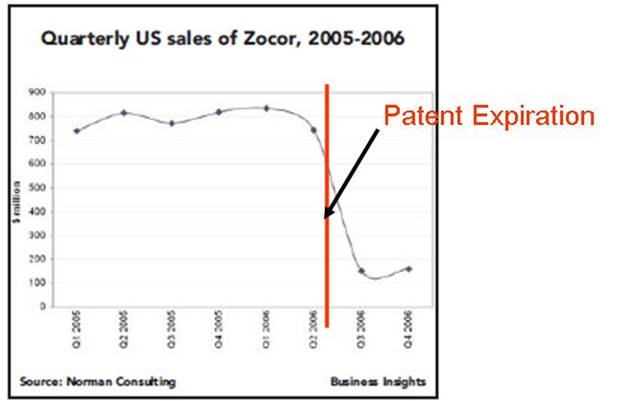

For

example, consider the drug Zocor, sold by Merck. The patent expired on June 23,

2006. (See this New York

Times article from that date for a discussion.) Figure 1 below shows U.S. quarterly sales of

the drug. Before patent expiration,

Merck was averaging sales of $800 million per quarter. As can be seen in the figure below, sales

immediately dropped to less than $200 million a quarter, a 75 percent

decline. Sales continued to deteriorate

beyond 2006 as generics ate away more of Zocor’s market share.

Figure 1

Source:

Norman Consulting: Patent Production Strategies

Drug

companies tend to make a disproporationate share of their profits from sales to

the United States. The same New York

Times article referenced above notes that of Zocor’s worldwide sales of $4.4

billion in 2005, a remarkable $3.1 billion were sales in the United

States. So even though the United States

represents only 5 percent of the world’s population and 25 percent of the

world’s income, it accounted for almost 75 percent of Zocor’s revenue that

year. This pattern holds more

generally. Mark McCllenan, former

commissioner of the Food and Drug Administration, has noted (see

this 2003 speech) that the United States accounts for about half of

worldwide drug company revenues, while Germany contributes only around 5

percent. Germany is a rich country

about one quarter of the size of the U.S., in both population and income. Yet it pays about one tenth as much in drug

expenditures. A similar story is true

about Canada. The Canadian government

bargains with drug companies to get the prices down. It is well known that drug prices are lower

in Canada than in the United States.

Residents who live in Minnesota have an incentive to cross the border

into Canada to buy drugs at a substantially reduced price.

Part 2: Patent and Drug

Pricing

Let’s

work through a numerical example to understand drug pricing with and without

patents. Suppose consumers throughout

the world have the same demand curve for a new drug, called wigitor and this is illustrated in

Figure 2 below. Suppose it is produced

by Econland Big Pharma, Inc. (If there really was such drug I might try to

get a prescription for it!) The drug is

prescribed to people afflicted with the dreaded disease of economyosis. Demand is

graphed on the basis of per person afflicted by the disease, so we can contrast

what happens in different countries that vary in population. For demand, we use the usual example where

the vertical and horizontal intercepts equal 10. The marginal cost is constant equal to $2

(this is also the average variable cost).

The $2 represents the production cost of making each wigitor pill. This is distinct from the fixed cost to

research and develop the drug (discussed below). We consider three possible cases for

pricing.

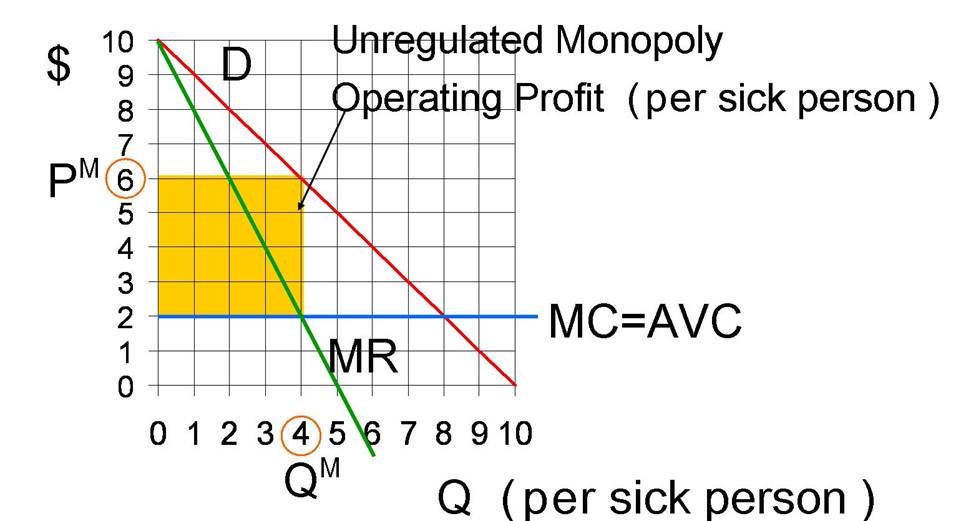

Case A: Econland Big

Pharma Has a Patent and Faces No Price Regulation

Suppose

first that Econland Big Pharma has a patent on wigitor. Suppose also that it faces no price

regulation. It can then act like

monopolist to maximize profit. Think of

this case as representing the United States.

(Well, the U.S. except for the Veterans Administration (VA). The VA

actually does bargain with the drug companies and obtains low drug

prices just like in

The

monopoly quantity (per sick person) equals 4 doses of the drug, because that is

where marginal revenue equals marginal cost of $2. At the monopoly quantity of 4 doses, the

monopoly price equals $6 per dose. This

yields a revenue per sick person equal to $6×4=$24. The variable cost to produce this amount per

sick person equals $2×4=$8. Define operating profit to be the difference

between revenues and variable costs.

Operating profit does not take into account any fixed cost of research

and development. Operating profit equals

$16 (=$24-$8) and is illustrated by the yellow box below.

Figure 2: Unregulated

Monopoly Price and Quantity for Wigitor (on a per sick person basis)

Case B: No Intellectual

Property Protection

Suppose

instead there is no patent on wigitor, no intellectual property

protection. Think of this case as

representing India which has a history of not recognizing patents on

drugs. (As will be discussed below, it

has recently signed an agreement to recognize drug patents.) Or it is the United States, after the twenty

year term of the patent is up. With no

patent, firms producing generic versions of wigitor can freely compete with

Econland Big Pharma. Free entry and

competition will drive the price down to the marginal cost of $2. In this case, Econland Big Pharma makes zero

operating profit. (It may be that

through advertising, Econland Big Pharma might be able to obtain earn a slight

premium for the brand name version over the generic, but let’s ignore that here

to make things simple. The example of

Zucor above makes clear that the ability to extract profits falls precipitously

when drugs are off patent.)

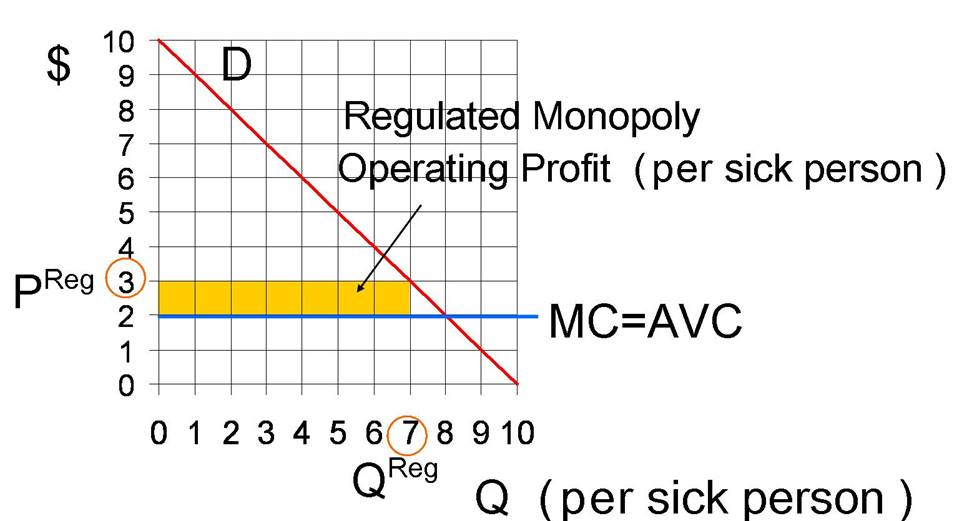

Case C: Patent

Recognition and Price Regulation

Now

consider a third case where a country recognizes Econland Big Pharma’s patent,

but regulates the price it can set for the drug. To put it another way, it sits down with the

company and bargains with it. Canada is

an example. Suppose Canada bargains the

price down to $3. It’s bargaining stance

is that if Econland Big Pharma won’t sell wigitor for $3 or less, it will just

tell all the doctors in

At

the regulated price of $3, the quantity is 7 units, and the operating profit is

$7=($3−$2)×7. The operating profit

is illustrated by the yellow rectangle in Figure 3.

Figure 3: Regulated

Monopoly

Let’s

put all of this together and examine the global operating profit Econland Big

Pharma can expect to receive if it develops wigitor. Let’s make the following additional assumptions:

·

The

demand per sick person described above is on an annual basis. If the firm gets a patent, it will be able to

make profits for 20 years while the patent is in force. To make things simple, we won’t take into

account the time value of money. (That a dollar twenty years from now is worth

less than a dollar today. Let’s put off

the concept of “present value” to another class.) So we will just multiply annual operating profits

by 20 to get operating profits for 20 years.

·

Assume

ten percent of the population is afflicted with the dreaded economyosis in any

given year.

·

United States: Econland Big Pharma will get a patent that

will last 20 years. There will be no

price regulation over this period. There

are 300 million people and this will remain constant over time. The demand per person remains constant over

time as graphed above. (In real world

applications, demand often shrinks towards the end of a patent’s life if new

and better substitute drugs are invented.)

·

Other Developed

Countries. There are 600 million people in other

developed countries like Canada and Germany.

These countries recognize the patent, but regulate prices to be no

higher than $3.

·

Rest of the World. The rest of the world does not recognize the

patent. Or even if they do, they are too

poor to buy drugs, so there is no money to be made from them in either case.

Let’s

put all of this together and calculate total operating profit over the lifetime

of the drug:

Annual Global Operating

Profit (in $ million)

= .1×300×16 (from

= $480 + $420 + 0

=$900 million per year.

To

understand the first term, observe that 10 percent of the 300 (million) people

in the U.S. get sick with economyosis in a given year and the operating profit

per year is $16 per sick person. This

delivers $480 million in annual operating profit from the U.S. The annual operating profit from the other

developed countries is a little smaller, $420 million, even though there are

twice as many people in these other countries.

This happens because these other countries regulate prices. Since the patent lasts for 20 years, we

multiple by 20 to get the operating profit over the lifetime of the drug,

Lifetime operating

profit: 20×$900 million = $18 billion.

Part 3: The Incentive

for Innovation

The

above analysis calculates the global operating profits to be had once wigitor

is invented. That is one important

factor entering into the decision of whether to invest in trying to develop the

drug. But it isn’t the only factor. Two other important considerations are:

First, the cost of the research and development (including costs of testing to

make sure the drug is safe and effective).

Second, the likelihood that the drug will be successful. The drug invention business is a risky one;

Many drugs turn out not to work, not to cure the intended disease. Or worse, the drugs might cause other

problems and have harmful side effects.

If it turns out that wigitor causes people to die of

politicalscienceosis, it will have to be pulled off the market (and numerous

lawsuits can be expected).

Suppose

that if Econland Big Pharma initiates an R&D project to create wigitor, the

likelihood of success (that it invents wigitor and that is cures economyosis

without harmful side effects) is 50 percent.

Since the project delivers $18 billion in operating profit if successful

and 0 otherwise, and since there is a 50/50 chance of the two events, the expected lifetime operating profit is

$9 billion (=.5×$18 billion). Define net

(lifetime) expected value of the project to be

Net Lifetime Expected

Value = Expected Lifetime Operating Profit − Fixed Cost of R&D

= $9 billion −

Fixed Cost of R&D

If

the fixed cost of research and development exceeds $9 billion dollars, then net

lifetime expected value is negative and Econland Big Pharma would certainly not

want to invest in this project. In

addition to being a bad deal in terms of expected value, there would be great

risk involved with the project. If the

research and development costs are less then $9 billion, then the project has

positive net expected value. The CBO

report mentioned above cites estimates of 800 million dollars for R&D fixed

costs for typical drug projects in recent years. I think it is quite likely that most big

pharmaceutical companies would be willing to pay $800 million dollars up front

in fixed R&D costs for a 50 percent chance at an $18 billion dollar payout

in operating profit.

Next

consider how a change in the extent

of intellectual property protection impacts the incentive to innovate. Suppose that instead of a 20 year patent

life, the law is changed so patents only last 5 years, a quarter as long. So now the operating profit if successful is

only .25×$18 billion = $4.5 billion. Taking into account that there is only a

50 percent chance of success, the expected operating profit is now only $2.25

billion. It is possible that Econland

Big Pharma might still choose to pursue this project. If so, it can be argued that it is a good

thing for society that the patent length was shortened, at least for this

case. We get the innovation either way

and the inefficiency of monopoly pricing is suffered for only 5 years rather

than 20 years. But if the fixed costs of

R&D are high enough that the company does not pursue the project under the

shorter patent (but would under the longer patent), then society is worse off

with the shorter patent. Wigitor is not

invented and society must live with the scourge of economyosis.

This

discussion highlights a tradeoff. If

patent protection is limited, there is less monopoly for a given amount of

innovation. (This increases total surplus).

But there is potentially less incentive to innovate. (This decreases total surplus.)

Part 4: International Agreements to Protect Intellectual Property in the Drug

Industry

As

noted above, drug companies typically generate little revenue from poor

countries for two reasons. Poor

countries can’t afford to pay much to begin with but on top of that, they

typically have ignored patents and have either produced (unlicensed) generic

equivalents themselves or purchased them from a country like India who produced

them. This is the same thing as buying a

knock-off CD or DVD.

It

isn’t that India didn’t recognize patents for anything. Rather, India’s 1970

patent law specifically excluded drugs from patent protection. India developed a large unlicensed generic

drug producing industry both for its own market and for other poor countries

(such as countries in Africa). One can

imagine India trying to motivate this exemption based on a moral case: That it

might be OK to patent a new kind of golf club but that it is “immoral” to

patent a life-saving drug. That may not

be the best logic: it is more important that there be incentives to create new

life-saving drugs than new golf clubs.

But this moral rhetoric is beside the point. It was in India’s self interest to ignore

drug patents. There was very little in

the way of any research and development in the drug industry taking place in

India to begin with. So these unlicensed

generic companies in India were not copying any Indian firms. Rather, they copied the innovations of

companies like Merck in developed countries.

In fact, India was better off that the developed countries did enforce patent laws in their own

countries. This created incentives for

companies like Merck to create new drugs that the Indian firms could then copy.

Naturally,

the big pharamceutical companies in the rich countries did not like this

situation and they lobbied to change it.

The opportunity to do something about it came from trade

agreements. The main agreement is called

Trade-Related Aspects of Intellectual Property Rights (TRIPS). See Barton (2004) for more information. The agreement dates from 1995 with subsequent

related agreements in 2001 and 2003.

Some of the main provisions came into effect in 2005. In this agreement, India and other developing

countries agreed to recognize drug patents.

They made this concession in return for trade concessions by rich

countries. In particular, that the rich

countries open their markets to goods like textiles from poor countries.

It

remains to see what will come of all this.

Poor countries like India are obviously not going to pay high prices for

drugs. So if drug companies want to sell

anything in poor countries, they will have to price discriminate and set very

low prices. In particular, with price

discounts much steeper than the ones Canada gets relative to the

In

2009, for example, India rejected patent applications for the HIV drugs

Tenofovir and Darunavir, which means the companies located in India that

produce generic equivalents of these drugs can continue to produce them. The plan is for these drugs to be exported

from India to Brazil, which has also rejected the patents. The Indian courts determined that these drugs

were not sufficiently new and novel compared to previous drugs and therefore

were undeserving of patent protection.

In contrast, in the U.S., the drugs were deemed sufficiently new and

novel to be granted patents.

Brazil

is also taking a tough line with the drug companies. As it is a medium income country, drug

companies want to charge it higher prices than poor countries pay. An Associated Press article

from May 2007 tells an interesting story about the HIV drug efavirenz. Brazil tried to bargain with Merck (the

producer of the drug) for a price of 65 cents per pill, the same price Thailand

paid. Merck argued that since Brazil was

richer than Thailand, it should pay $1.10 per pill, which was still a discount

down from the $1.57 per pill Merck was charging rich countries. After Brazil failed to get the 65 cents per

pill price, it decided to ignore the patent and instead buy “knock-off”,

unlicensed, generic equivalents of the drug.

Final Comments

Comment 1: For-profit drug companies like Merck

unsurprisingly direct R&D efforts towards drugs with the potential to

deliver high operating profits. These

are drugs that people who live in rich countries are going to use. So we see, for example, R&D investment

for many kinds of drugs to address erectile dysfunction. Merck has little incentive to invest in drugs

that are only used in poor countries because poor countries don’t want to pay

for them. (See above.) If such drugs are going to be developed,

someone has to be willing to pay for them.

The Bill and Melinda Gates

Foundation is an example of one such “someone.” For example, it is working to create new

vaccines for tuberculosis and has spent 750

million dollars to date on this project.

Comment 2: Part 3 above laid out

the standard economic argument for the tradeoffs involved when patent

protection is increased. For fixed levels

of innovation there is more monopoly.

But with more patent protection, there is more innovation. There is an important school of thought

challenging the notion that increasing patent production necessarily increases

innovation. In particular, Boldrin and

Levine (2008) make strong arguments that firms can use patents to block

innovations of rival firms. You can

check out their web site at “Against

Monopoly.”

Comment 3: For related issues involving technology to

prevent malnutrition, see this very interesting article “The

Peanut Solution,” New York Times Magazine, September 2, 2010.

References

Barton, John H. “Trips and the Global

Pharmaceutical Market,” Health Affairs, 23, no. 3 (2004): 146-154. Web

link

Boldrin, Michele and David K. Levine, “Against

Intellectual Monopoly,” Cambridge University Press: New York, 2008. Web

link

Butler, Declan, “India says No to HIV drug

patents,” Published online 3 September 2009, Nature New

doi:10.1038/news.2009.882 Web

link

Congressional Budget Office, Research and

Development in the Pharmaceutical Industry,” October 2006. Web

link